By 2026, Indonesia is expected to have approximately US$150 million in hotels and resorts under development due to the resurgence of tourism and government assistance. With all the factors contributing to increased demand for hotel occupancy during peak-tourist periods, improved government policies towards travel-related incentives, continued growth of the hotels and restaurant industry, and the continuation of tourism redevelopment projects by the government, Savills predicts that the hotel market will continue to advance rapidly through 2025 and beyond. Hotel investment activity will be at an all-time high in Indonesia, as several projects will be completed before the Christmas and New Year holidays. As part of this increase, the government intends to implement a national tourism development stimulus package consisting of transportation discounts (including air, sea, and land), which should provide additional motivation for Indonesians to travel domestically.

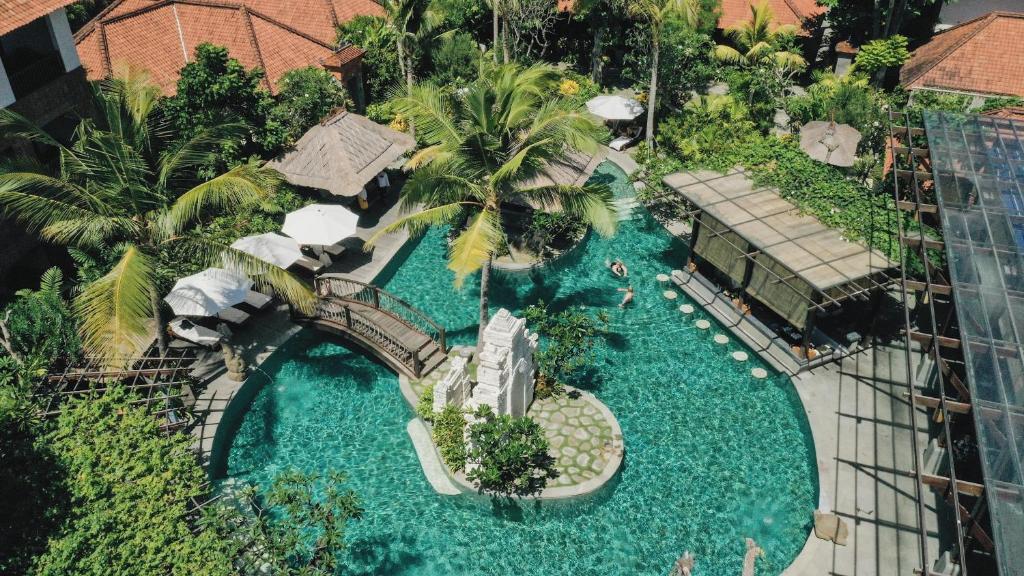

According to Savills, consumer spending within households is expected to improve toward the end of the calendar year and support hotel revenues that have been declining with poor occupancy levels seen within the hotel sector since the beginning of 2025. In addition, Savills points out that the Ministry of Tourism and Government is looking at using hotel tax incentives to create a more stable operating environment for hotels. Although the use of tax incentives may complement the efforts of hotels to improve occupancy rates and maintain them, their success is subject to the timely execution of such incentives. Savills stated that they have a favorable outlook for the Indonesian hotel industry in 2026 as investment pipeline continues to recover. Investments in the pipe line may reach as high as US150 million and will be driven by improvements in the fundamentals of the tourism sector and the introduction of government assistance. Savills' report highlights the significant impact that two important geographical areas have on investment activity. Bali is continuing to see a significant rebound in its hotel market with a proven foundation of superb performance — reportedly outpacing other region’s luxury destinations, like Phuket and Koh Samui in Thailand. The other market, Jakarta, remains the primary entry point into Indonesia. In their report, Savills noted that there has been a strong increase in the average daily room rate for hotels in the capital, mostly due to many more government and business MICE events being held. Both Bali and Jakarta are integral to the upward trend in the Indonesian hotel investment marketplace, according to Savills, who advises that these two markets will play a crucial role in defining trends in hotel investments through 2026.Savills' report highlights the significant impact that two important geographical areas have on investment activity. Bali is continuing to see a significant rebound in its hotel market with a proven foundation of superb performance — reportedly outpacing other region’s luxury destinations, like Phuket and Koh Samui in Thailand.

The other market, Jakarta, remains the primary entry point into Indonesia. In their report, Savills noted that there has been a strong increase in the average daily room rate for hotels in the capital, mostly due to many more government and business MICE events being held. Both Bali and Jakarta are integral to the upward trend in the Indonesian hotel investment marketplace, according to Savills, who advises that these two markets will play a crucial role in defining trends in hotel investments through 2026.